Conversational Lead Funnel

Rocket Companies2023Every Rocket Mortgage client starts in the same place, filling out one of two digital lead forms then talking with a mortgage banker. The primary lead form, however, ends at a frustrating dead end while the client unexpectedly receives a phone call. The hypothesis is this experience was the primary driver for low top-of-funnel success rates. The challenge was to measurably improve the lead form experience without negatively impacting lead flow.

Role

I was the Director of Design. My cross-disciplinary design team was partnered with the growth product design team, engineering, data, banking, and product teams.

Outcome

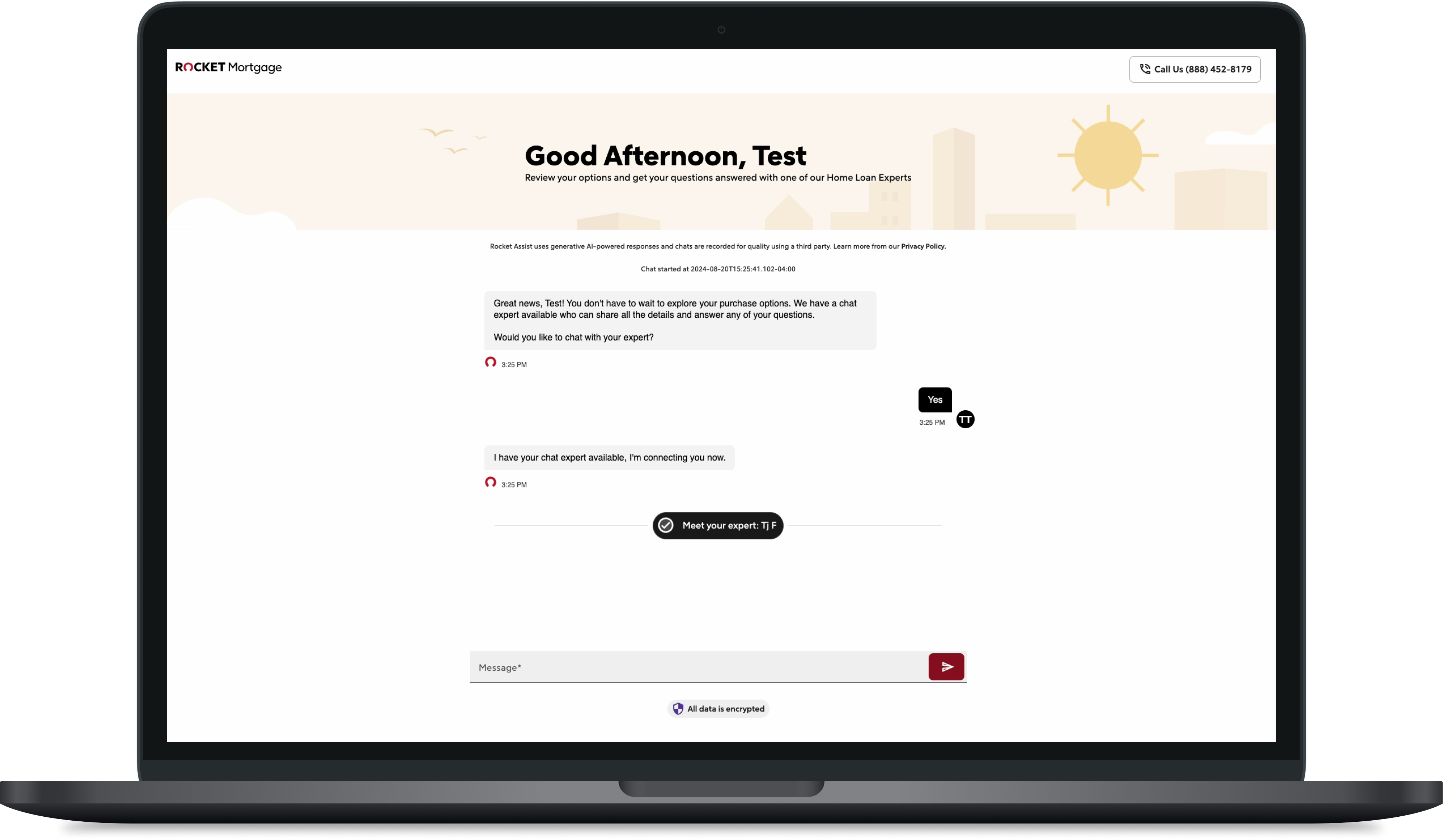

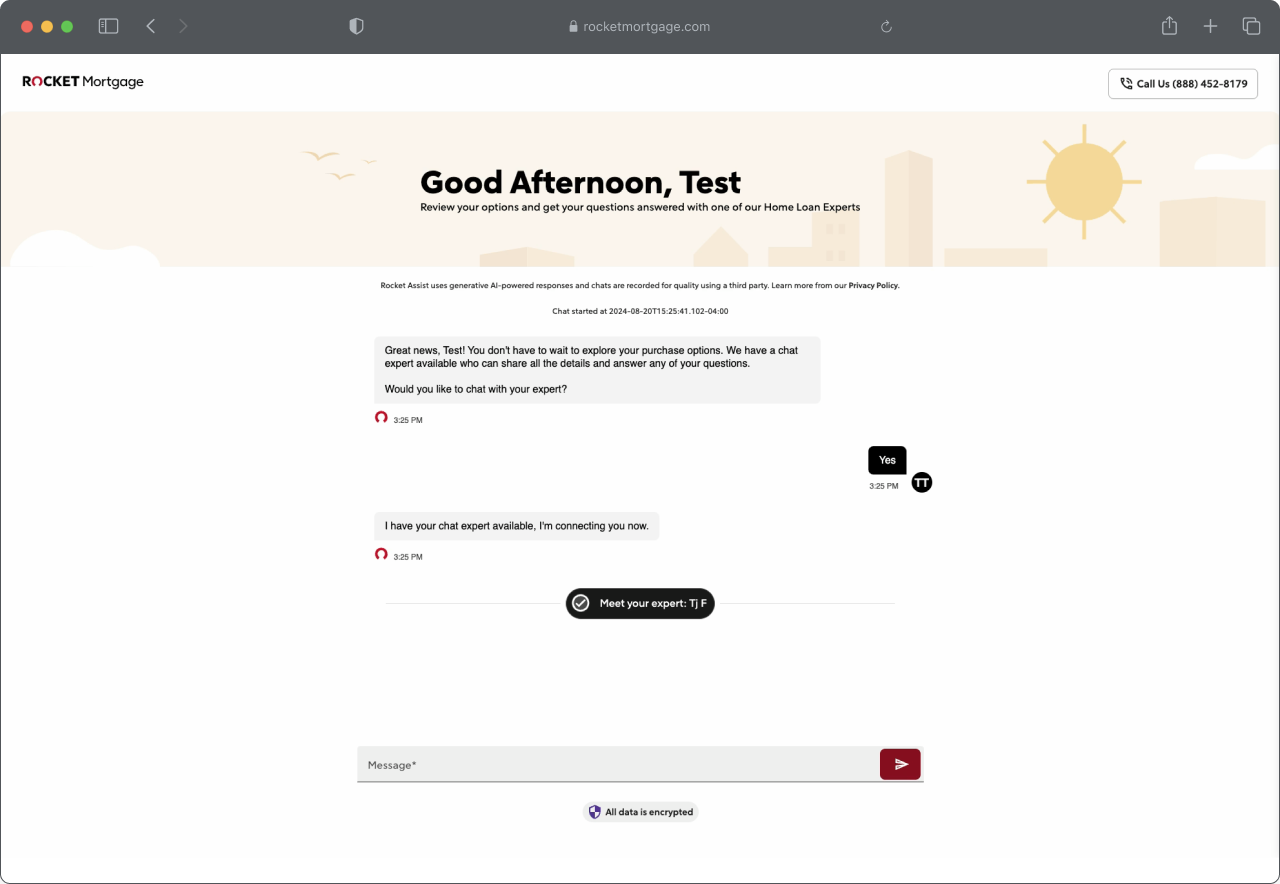

At the end of the lead form, we launched a gen AI powered chat that connects a client to a mortgage banker – all within the same chat experience.

To do this, we overhauled the architectures of the lead form and conversational AI. We also designed a net-new, full-browser, personalized chat experience.

We launched this new experience during after-hours where nearly half of all leads were coming in, creating the biggest opportunity and addressing a major experience pain point.

We saw a significant increase in lead conversion and estimated ARR (annual recurring revenue).

Key Challenges

Validate Assumptions

We assumed people clients didn't like the dead-end and the disjointed experience of receiving a phone call from a mortgage banker within seconds of filling out a form. We also assumed most clients would prefer a chat experience with a mortgage banker versus a phone call. So, we asked clients what they wanted to do at the end of the form, get a call or chat. We ran this "smoke test" for two weeks on a slice of traffic. The results strongly indicated clients at the end of the lead form preferred chatting versus getting a phone call.

Design

We created a full-screen/full-browser conversational UI that enabled clients to chat with our conversational AI and mortgage bankers. The AI was powered by ChatGPT and integrated with Salesforce for mortgage banker chats. We also added light personalization by leveraging client info gathered from the lead form including their name, property type, and local time of day.

Derisking

Mortgage bankers aren't staffed 24/7 yet launching during core hours poses the highest business risk. We found that a large percentage of clients submit leads during after hours, aren't able to get immediate help, and have lower success rates. This presented us with the opportunity for lower risk and greater positive impact. Aligning with the banking business, we staffed mortgage chat bankers during after hours.

Want to talk about this project?